OVERVIEW

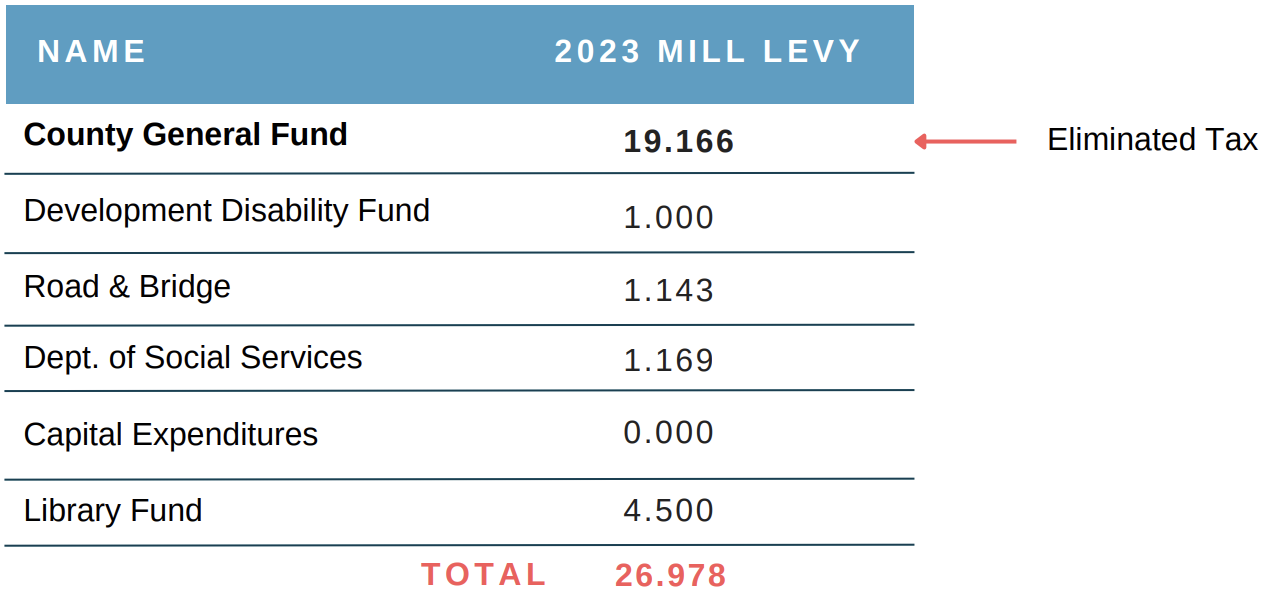

Jefferson County realizes the importance of growing its primary employment base to strengthen the local economy. As a benefit to the region’s businesses, the county has eliminated its portion of the business personal property tax to show the business community that it values their business and understands that decreasing the overall tax burden will yield more jobs and capital investment. Jefferson County is the first county in Colorado to eliminate its portion of this tax. The elimination only applies to the county’s portion of its BPPT, payable to the general fund, and does not apply to other funds, including the development disability, library, R1 school district, urban renewal, and other special district funds. Below is a table with the various funds under the BPPT, with the general fund mill levy highlighted in the chart below. This began with BPPT attributable to calendar year 2018, payable in 2019.

2023 Mill Levy Breakdown Table

Calculation Example

The following is a sample formula for calculating the savings from the elimination of Jefferson County's portion of the Business Personal Property Tax:

Value of personal property x 27.90% (assessed value) x current year mill levy = amount of tax savings for year

EXAMPLE:

$10 million in business personal property x 27.90% (2023 assessment rate) x 19.166 mills (or .019166) = $53,473