OVERVIEW

Jefferson County Economic Development Corporation, in partnership with the Rocky Mountain Metropolitan Airport (RMMA) recently created a foreign trade zone (FTZ) for Jefferson County. FTZs are secured, designated locations around the United States in or near a U.S. Customs Port of Entry where foreign and domestic merchandise is generally considered to be in international commerce and outside of U.S. Customs territory. As a result, activated businesses in an FTZ can reduce or eliminate duty on imports and take advantage of other benefits to encourage foreign commerce within the United States.

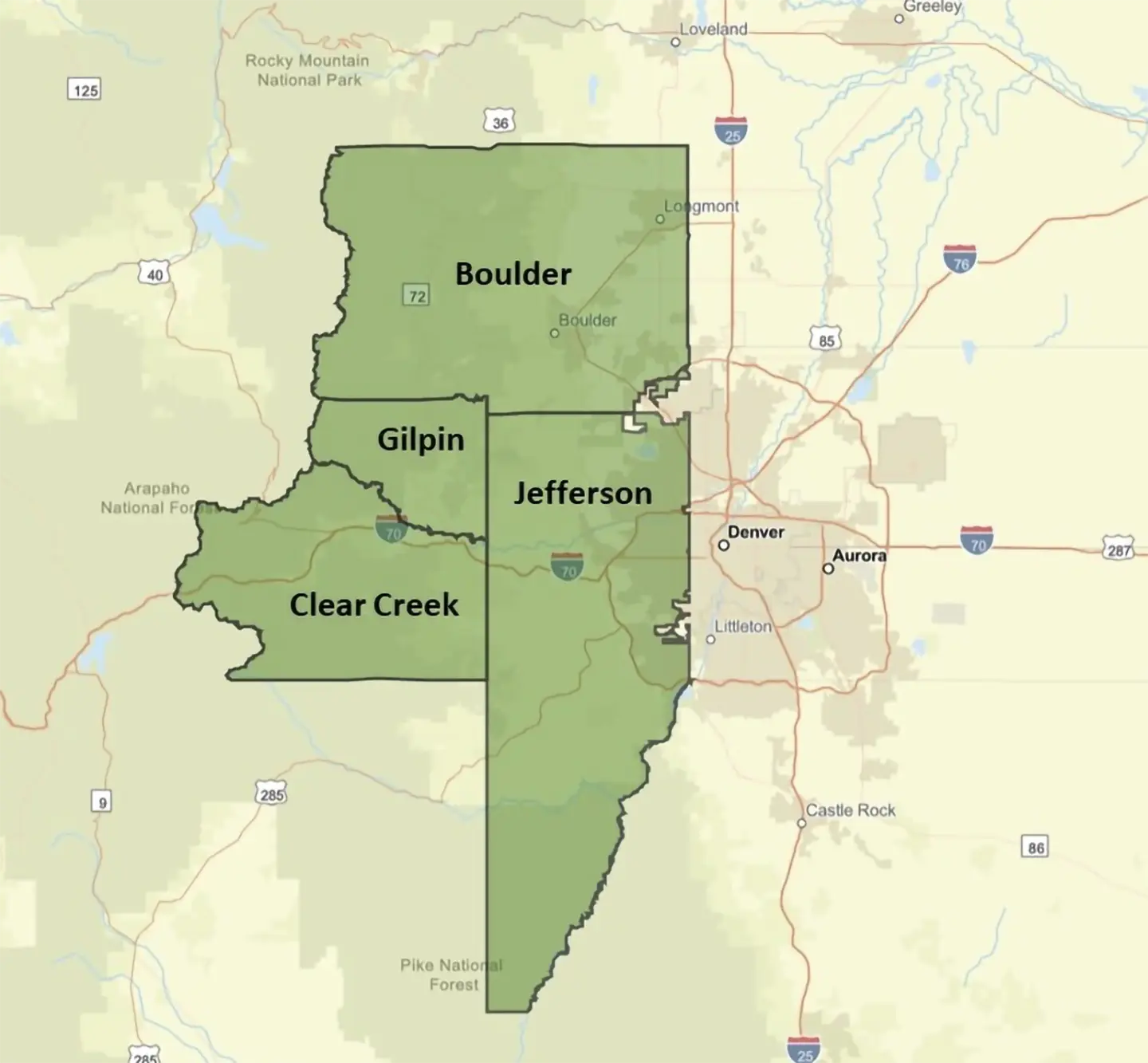

FTZ #298 Service Area

Advantages

Duty Exemption — Merchandise may be exported out of the U.S. duty free.

Duty Deferral — Duties are paid only when goods enter U.S. Customs territory.

Duty Reduction — Manufacturers may pay the lower duty rate applicable to either component materials or merchandise produced.

Merchandise Processing Fee (MPF) Reduction — MPF is only paid on goods entering the U.S. Customs territory.

Streamlined Logistics — Upon approval from Customs, imports may be directly delivered to the zone.

Quota Avoidance — In most instances, imports subject to quota may be retained within a Foreign-Trade Zone once a quota has been reached allowing zone users access to potentially discounted inputs and the ability to admit merchandise as soon as a new quota year starts.